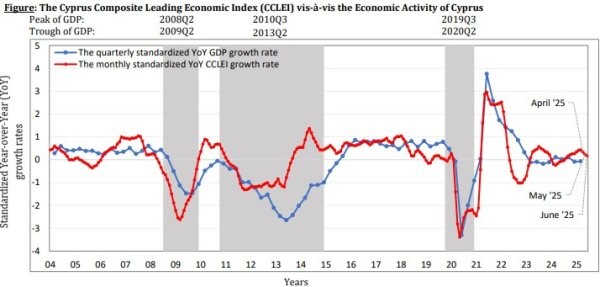

The Cyprus Composite Leading Economic Index (CCLEI) sees moderate growth in June 2025, indicating a continued but tempered upward trend in the country’s economic outlook, according to a report from the University of Cyprus.

Photo: financialmirror.com

Constructed by the Economics Research Centre (CypERC), the CCLEI recorded a year-on-year increase of 2.3% in June, reflecting a decrease from previous months, which saw growth rates of 2.6% in May and 3.1% in April. This moderation points to a slowdown in the growth rates of individual indicators that feed into the index.

Significantly, the report highlights that the economic climate in the euro area has deteriorated, contributing to the slowdown. This aligns with a weakening growth rate of the Economic Sentiment Indicator (ESI) in Cyprus, suggesting that broader economic pressures are at play. Additionally, weekly data on electricity production, adjusted for temperature, showed a decline in annual growth rates.

Despite these challenges, several factors supported the growth of the CCLEI. Positive contributions stemmed from various sectors, including property sales, an increase in tourist arrivals, and a rise in transactions made with Cypriot credit cards. Retail trade sales volume also showed encouraging signs, suggesting resilience in domestic consumption.

Furthermore, a notable decline in Brent crude oil prices over the same period has provided some relief, potentially easing inflationary pressures that could affect consumer spending and investment. This combination of factors indicates a complex economic landscape where growth is being bolstered by specific sectors, even as challenges loom from external conditions.

The report’s authors caution that the geopolitical conflicts in the Middle East could significantly impact international energy markets. This ongoing uncertainty necessitates careful monitoring and assessment of the medium-term economic prospects for Cyprus. As external pressures mount, the economic outlook remains cautiously optimistic yet vigilant.